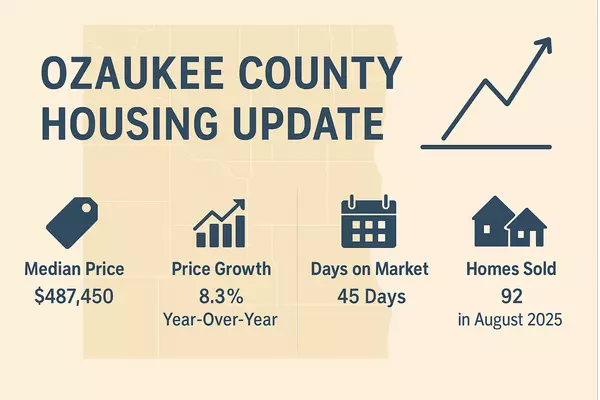

Ozaukee County Housing Update: What Buyers and Sellers Need to Know Now

Ozaukee County Housing Update: What Buyers and Sellers Need to Know Now What are the latest real estate trends in Ozaukee County, and how should they influence your next move? The Ozaukee County housing market is showing signs of both strength and transition. While prices continue to rise, homes are

Read More-

How to Sell Your House Faster: Home Presentation Tips That Work What are the most effective ways to present your home so it sells faster in Milwaukee? To sell your house faster in the Milwaukee market, you need to make a powerful first impression. That means improving curb appeal, cleaning thoroughl

Read More -

Buying a home is a complex process that involves several steps. Here's a general list of things buyers should do from start to finish when purchasing a home: 1. **Assess Finances:** - Review credit score and history.- Calculate the amount you can afford using online calculators or consulting with a

Read More -

Selling a home is a comprehensive process with numerous steps. Here's a general list of thingssellers typically need to do from start to finish when selling their home: 1. **Determine Motivation and Timeline**:- Decide why you are selling (e.g., upsizing, downsizing, relocation).- Determine when you

Read More